Why 2026 is the ‘Accumulation Year’ for Mining Hardware

“As we enter the first quarter of 2026, we are seeing a ‘Price-to-Hash’ decoupling. Historically, when Bitcoin stabilizes, hardware manufacturers lower prices to clear inventory for next-gen releases. This creates a window where CAPEX (Initial Investment) is low, but Yield (Monthly Revenue) remains high.

The Top 3 Mining Strategies for 2026:

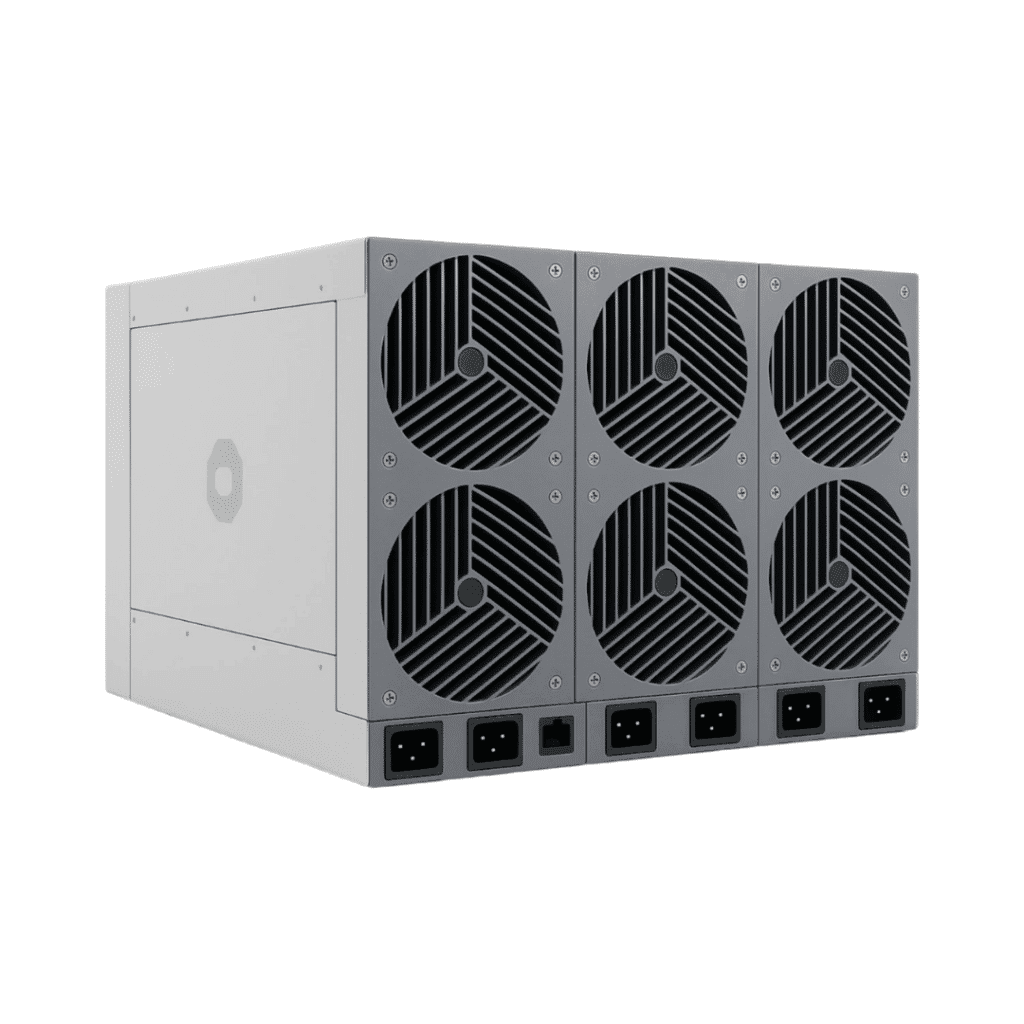

- Low-Cost Expansion: Using the Antminer S19k Pro to scale hashrate quickly while the cost-per-terahash is below $5.

- Efficiency Hedging: Deploying the S21 (200T) to stay profitable even if network difficulty increases by 10-15%.

- The Scrypt Supercycle: Using the Antminer L9 to capture the surging value of Dogecoin and Bellscoin, which often outperform BTC in mid-cycle rallies.”